FCF.is | Free Cash Flow Is

Understanding the cash flow activity of the organization creates insights to drive results. The cash performance report creates a clear cash flow picture of the organization by merging the Income Statment and Statement of Cash Flows. The resulting financial reporting distills the movement of cash in the company to create a clear perspective of the net cash gain.

On the first day of the month, the company turned on the lights, then shut them off on the last day of the month. Every leader knows a lot of effort took place throughout the company during the month. Sales were booked, bills were paid, and the customer’s goals were achieved. After all of the initiative, work, turmoil, angst, and success during the month, did we end with more cash? If not, why? The Cash Performance Report illustrates where all of the money went.

The Cash Performance Report is a special management report and not an official GAAP financial statement. The report brings together the official GAAP statements in a unique way to clarify cash flow in the company. It is merging the cash flow information found on the Income Statement, Balance Sheet, and Cash Flow Statement into one Net Cash Gain result. The Net Cash Gain tells the business leader how much cash increased or decreased in the same period as the financial statements.

EBITDA Is Not Cash

Many business leaders focus on EBITDA or Earnings Before Interest Taxes Depreciation and Amortization as a proxy for cash. EBITDA equaling cash flow may be true in simple operations.

The income statement correctly records the profit during the period according to the rules of GAAP or Generally Accepted Accounting Principles. The Income Statement does its job and provides an accounting of the profit the company earned by selling its products. With the Cash Performance Report, business leaders can analyze the cash movement that happened at the same time as those sales.

The income statement is correct and shows how much profit the company made in the period. At the same time, profit does not mean cash in the bank. With the cash performance report, they can see the interaction between the income statement, balance sheet, and cash flow statement. Profitable companies die because they run out of cash. To grow, business leaders need to manage both profitability and cash.

Cash From Sales

Cash from sales is the first section of the report. The opening lines duplicate the revenue lines from the income statement. For many businesses, this is the Net Product Sales, Net Service Sales, and Other Revenue lines. Then there is a new line added labeled cash from (lending to) customers.

The adjustment to revenue is the change in cash for accounts receivables outstanding or invoices that the customers have not yet paid. When a customer does not pay the invoice for the products they have received right away, the effect is that the company has lent them the money. Many companies naturally expect customers to take thirty to forty-five days to pay an invoice. Sometimes special terms are agreed to, and the customer has ninety-days or even six months to pay the invoice. By making this adjustment, we can see what the total cash in-flow was to the company.

The Cash From Sales total could exceed the Revenue line from the income statement if the total accounts receivables balance declined due to customer payments. The company has not sold a product or service until the customer pays for the product or service.

The Cash Performance Report also illustrates in a chart the difference between Cash From Sales and Net Revenue over time.

Gross Cash Gain

Gross Cash Gain is the second total on the Cash Performance Report. The total is the cash equivalent to the gross income from the income statement. Included here is the typical cost of goods and services sold lines from the income statement, with an adjustment for cash activity from the statement of cash flow. Inventory is a significant cash activity related to the cost of sales. The second cash adjustment is for accounts payable tied explicitly to the cost of sales vendors. Identify the AP movement by isolating the vendors that provide the raw materials, services, and other inputs into to sell the company’s products and services.

The illustration below indicates that inventory growth consumed a large amount of cash flow during the period. Inventory is a buffer that helps protect the company from vendor disruptions and ensures the company can provide excellent service to the customer. At the same time, inventory is a risk since it can become obsolete, be damaged, or even stolen. Balancing these factors together is a crucial consideration of management.

Gross Cash Gain and Gross Profits are illustrated together on the report as a graph with trends over time. This graph provides a visual reference to see how the two correlate. The change in inventory levels in the current year draws your attention to the wide divergence.

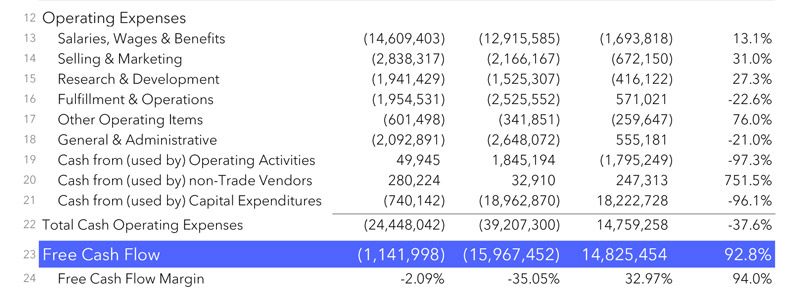

Operating Expenses

The third section of the Cash Performance Report is the Operating Expense group. Again the report duplicates the operating expense lines from the income statement and continues with the cash adjustments from the statement of cash flow. Here we add the balance of the accounts payable cash flow that is related to non-trade payables. Then a valuable addition is made for the cash spent on capital expenditures.

Capital expenditures are sometimes called “Cap-Ex” (pronounced cap x) and is money spent on buying assets used in the business like machines, computers, buildings, and factories. Capital expenditures are the use of cash placed back to work inside the operations to fuel future growth. The company could buy new production machines so it can increase profits in the future. The company builds new factories so it can produce more products and increase profits in the future. Sometimes a certain amount of capital investment is required just to keep the current sales volume the same. A new service truck might need to be purchased to replace an old and worn out truck. The new truck will not increase sales since the truck will continue servicing the same customers. Yet, not buying a new truck will cause a drop in sales when the old truck breaks down. These capital expenditures are a significant use of cash but only show up on the balance sheet as an asset and depreciate the asset’s life to the income statement.

Free Cash Flow

Free Cash Flow is the measurement of company performance leaders must focus on to grow. A company that has a robust Free Cash Flow is demonstrating the ability to purchase assets such as property, equipment, and other significant investments from the operating cash flow. Strong free cash flow is how the company creates the ability to self fund the cash needed to grow. The company can use the Free Cash Flow to expand operations, hire additional employees, and invest in other assets to increase future profits. If management decided that the company’s investment opportunities were not lucrative enough, they could use the cash to acquire another business or provide a dividend to the shareholders.

Free Cash Flow is a quality indicator of the company’s overall performance because it removes the accounting adjustments and reflects the increase or decrease in cash during the month or year after capital expenditures. Free Cash Flow is the cash remaining after capital expenditure and sometimes gets distorted by significant capital investments.

The Cash Performance Report includes a trended graph that compares Free Cash Flow and EBITDA with the team. A consistent trend of a positive and growing Free Cash Flow is what the company wants to have on the chart. A positive Free Cash Flow trend provides the company options when needing to raising capital, acquire another business, or even attract other investors to buy the company.

Free Cash Flow measurements should always be compared to peers within the same business line or industry because of the fluctuations in capital expenditures. If a company is generating excessively high Free Cash Flow, it could indicate the company is not making the needed investments back into the business to ensure future growth or possibly to merely keep pace.

Negative Free Cash flow is not always an immediate cause for alarm. The company may have a dramatic decline in Free Cash Flow because of significant capital expenditure. Digging deeper will help reveal the cause of the fall. Investments in future growth can be okay unless the trend never seems to recover. The takeaway is the consistency over a long-term time horizon. It is possible that a prior growth strategy has not paid off and is now a negative drain on the company.

Using Free Cash Flow as the benchmark for performance keeps leaders focused on the health of the company. Having a substantial amount of cash flow says the company has plenty of money to pay the bills, with enough left over to pay off debt and potentially distribute to investors.

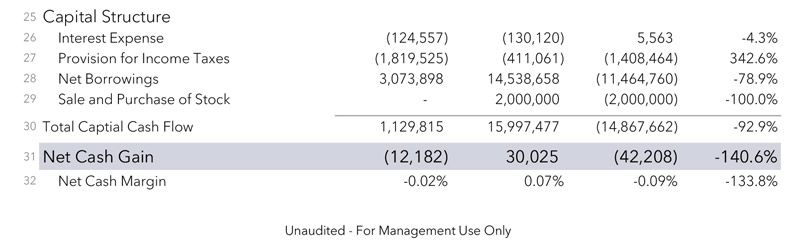

Capital Structure

The capital structure of the company is unique to the business strategy of the owners of the company. Each owner decides if they prefer to finance the company with more debt and less equity or maybe only equity and no debt. The founders choose the legal form of the company at startup. They select among being a proprietorship, partnership, a corporation, or one of the variations some states offer. Choosing the capital structure is more about accomplishing the owner’s goals and less about the type of industry of the company. The owners may decide to change the capital structure to achieve new goals they may have.

On the Cash Performance Report, we can see the outcome of these decisions on cash flow. By having debt, the company must pay interest to its lenders which becomes an expense of the company. As a corporation, the company pays business taxes to federal, state, and local governments in various forms. The company may increase or decrease its debt, and the resulting change is labeled “net borrowings.” An increase in debt is a source of cash, and paying debt becomes a use of cash. A corporation can sell an ownership interest in the form of stock to receive cash and may buy back the stock from the investors from time to time, which would be a use of cash. Investors could anticipate a dividend, which rewards them for the risk they have taken by investing in the company. Dividends are a use of cash and depend on the strategy of the company.

Net Cash Gain

The net cash gain is precisely equal to the change cash for the period reported. The difference between the cash at the beginning of the month versus the total cash at month-end becomes the net cash gain. Cash is the checking accounts, savings accounts, and any other bank accounts that hold cash or “near-cash” by the business. A certificate of deposit is a particular savings option a bank offers, which is a form of “near cash.”

The total net cash gain should match the net increase or decrease in cash line from the statement of cash flows.

The Five KPI Metrics

The right side of the Cash Performance Report has five key performance metrics for the company. Each company is unique and may track slightly different metrics that are meaningful to their business.

-

Strength

The selected metric should show the overall health of the company. We picked Days Cash Available, which is the cash the company has plus available borrowing capacity divided by the daily expense burn of the company.

-

Growth

This metric measures the rate the company is expanding sales. As long as we have inflation, any company that is not growing is shrinking. To measure growth we use Cash Sales Growth. Not just sales growth but the growth in cash flow from sales. Focusing on Cash Sales Growth is essential for the company if AR collections have been weak.

-

Speed

How fast is the company generating cash? The Cash Cycle metric shows the number of days cash is locked up in the company. The measurement starts at the initial inventory purchase and ends when the customer pays the invoice. The Cash Cycle is the cash stopwatch for the business.

-

Performance

We selected the Free Cash Flow margin as the performance metric of the company. Free Cash Flow is often best viewed over a long-term trend because of capital purchases.

-

Fuel

The fifth metric is cash fuel to grow the company. A business that is generating steady free cash flow can self-fund its growth. We are using the Internal Growth Rate of the company as this metric.

Leading with the Cash Performance Report

Finive will generate the Cash Performance Report for your business or you can create the report within your accounting software. With the report in hand, your team is able to move the leadership team of your organization to make well-reasoned cash flow decisions that drive a profitable organization.

Finive also goes one step further when creating a forecast for your organization and creates a forecasted Cash Performance report to illustrate where you are headed.

Do not become the next profitable company to fail because you run out of cash.